A trifecta of life changing events – illness, job loss or divorce – often starts an avalanche of financial problems that results in bankruptcy.

A trifecta of life changing events – illness, job loss or divorce – often starts an avalanche of financial problems that results in bankruptcy.

Most of us are one serious illness or injury away from medical bills we can’t afford to pay, even when we are lucky enough to have good health insurance.

Bankruptcy Stops Garnishments

When you can’t pay your medical bills, you may be sued.  Once the creditor wins the lawsuit and gets a judgment against you, 25% of your pay and 100% of your bank balance can be seized in Kansas. Bankruptcy is a way to stop the garnishments.

Last Resort

“People do not go into bankruptcy lightly:Â They go into bankruptcy after they have exhausted all other options,” says my Bankruptcy Law Network blogging colleague Kevin Gipson. “This often means they have maxed out their credit cards, borrowed money from friends and loved ones, and even worse, gutted their retirement plans to pay their debts.”

You Are Not Alone

Kevin Gipson has written a five-part series on considering bankruptcy to get rid of your medical bills:

Considering bankruptcy to get rid of your medical bills?  You are not alone. In Part One, “we learned that many Americans, whether or not they had health insurance, had experienced problems paying their medical bills.”  In Part Two, “we saw the cost of health care is a major factor for many Americans when having to make day to day decisions regarding how to allocate what are frequently limited funds.”

In Part Three, “we discussed how the chronically ill, disabled and handicapped often have a tougher time paying their medical bills than their healthier counterparts. Often a bankruptcy can be used as a way to get rid of these bills and also can be a way to free up money to make health, vision, dental and disability insurance affordable.”

In Part Four of this series we saw how low income to moderate income individuals had a much more difficult time affording health care and medical insurance. Part Five discusses options for negotiating the medical bills and applying for assistance with the providers and filing bankruptcy to get rid of the medical bills.

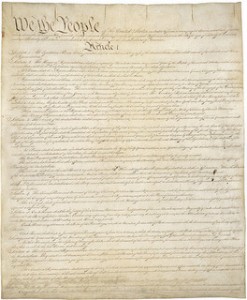

Photo Credit: By 2sirius